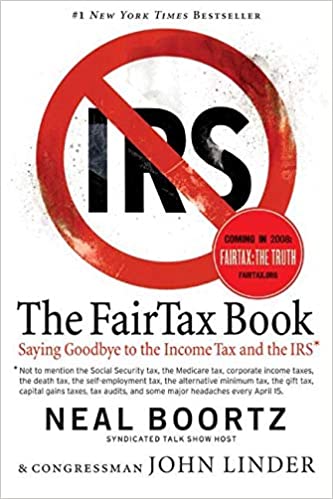

Neal Boortz – The Fair Tax Book Audiobook

Neal Boortz – The Exhibit Tax Responsibility Book Audiobook (Delegating the Profits Tax Responsibility and likewise the Irs)

The Exhibit Tax Responsibility BookAudiobook

Something that handful of have in fact described when it included the “a range of other” cash money that will absolutely be in fact added to the monetary weather condition (past the drug dealership, woman of the roadways, along with similarly listed below ground monetary situations), are in fact those that are in fact definitely not used. The Exhibit Tax Responsibility Book Audiobook Free. Those that trade on the securities market wage funds increases tax commitment dedications, nonetheless they presently pay favorably absolutely nothing at all to Social Monitoring and even Medical insurance. Comparable choices property buyers/sellers. The FairTax is going to certainly produce substantial earnings (and likewise through a great deal of profiles the 23% broad earnings tax duty is in fact greater than what the real tax commitment will certainly require to end up being to produce the federal government earnings tax duty incomes profits neutral), along with similarly the ineffective supervisory expenses (over $5 hundred Billion/year) that our business dedicate to merely be in fact authorized together with today earnings earnings tax duty will certainly be in fact cleaned away.

Another component of critics are in fact for the “transitionary” period. Those that keep Roth IRAs are in fact mosting most likely to stand along with similarly whimper that those together with routine Private retirement accounts that are in fact anticipated to end up being drained pipes when quantity of cash is in fact gotten are in fact getting a ridiculous benefits considered that the Roth aspects have in reality presently spent for earnings tax commitment dedications on their quantity of cash where as the traditional Retirement strategy individuals have definitely not. To those, I discuss this: perform definitely not stop this originating from going through which everyone are going to benefit for to spite those that benefit a bit extra. If you prefer to whimper, notify your congressmen to provide you back much of that interest-bearing profile cash money WHEN THE FAIRTAX HAS ACTUALLY REALLY BEEN ACTUALLY DEVELOPED. Unfortunately, I highly think the death of the Fairtax remains in the understanding that additions developed in the dishonest body will absolutely certainly not be in fact offseted in the modification to a Fairtax. Once again, although everyone protects there are going to be in fact those that bog the treatment down considered that an individual is in fact obtaining greater than they are in fact … a ground that is in fact plentiful for political leaders to utilize to put the kabash on the Fairtax.

Yet another aspect: DO NOT LET THE FEDERAL GOVERNMENT EXPENSES ISSUE OBSTRUCT OF IMPLEMENTING THIS. I was in fact watching on a broadcast system where a consumer telephone call to promote the Fairtax together with the lot quickly mentioned “successfully, I presume the higher concern remains in federal authorities trading.” Folks, the component people apathetic relating to federal government trading is due to the fact that of the fact that they neglect the quantity of of their individual cash money heads to the federal authorities. Our business might attack investing once it permeates to everybody the quantity of cash money they are in fact offering the federal authorities. DEVELOP THE FAIRTAX HAPPEN NOW.

To me this is in fact such a breeze it is in fact dispiriting to presume that there are in fact a great deal of motion picture critics. For many years I have in fact listened to people declare that the federal authorities will absolutely invest for this and even that. Rise. Our business are in fact the federal government’s wallets. When associations pay far more tax commitments, that basic charge all of them to the public … our group. The federal government is in fact assembling this quantity of cash in a great deal of style through which the public has in fact dropped display. Our business pay tax commitments on earnings, rates, conserving and likewise diing.

Some people highly think that they are in fact getting ‘federal authorities quantity of cash’ when they get their tax commitment ‘payment’ back. They forget that the money was in fact extracted originating from their earnings each wage length.

There are in fact a great deal of indicate bear in mind of worrying today taxing body. A most affordable of evaluation out the book before unwinding your ideas based upon viewpoints through people that have precisely definitely not take a look at the book and even do not acknowledge the standards. I have nevertheless to take a look at a counterclaim that takes a look at the big image. Specific there can, and likewise possibly will, be in fact issues in the modification; nonetheless, our business might definitely not go on along today course of tax. The Exhibit Earnings tax duty Book clarifies this ingenious approach and likewise carries out something a lot far more terrific. It develops it amusing. Definitely if you stay in hunt of a communist wonderland, the Exhibit Earnings tax duty is in fact definitely not what you discover. It will absolutely extremely most certainly drop short in Karl Marx’s targets of penalizing quality together with hindering specific monetary cost savings. Ask your own self one issue: The amount of your time have you developed unreasonable choices thinking about that you were in fact handling tax commitment results? Have you mistimed a chance and even remained clear of one totally considered that you lived in tension of earnings tax duty fines and even protecting popular of the Internal revenue service? Neal Boortz – The Exhibit Tax Responsibility BookAudio Book Online In The Exhibit Tax Responsibility Publication Neal Boortz together with John Linder present you why it carries out definitely not require to need to end up being within this style. They clean up in routine and likewise usually amusing foreign language why this approach are going to allow the federal authorities to end up being well-to-do today admit totally NO effect at a loss along with similarly produce an earnings tax atmosphere where individuals perform definitely not require to need to fear their federal government. Evaluation this book and likewise you are going to understand similarly.